A CQN’er prepared this forensic analysis of the relative poverty of Newco (formally named for analysis) compared to Celtic. It covers where they currently are and, more importantly, brings into sharp focus their financial projections for next season.

A storm is coming.

It’s International week, so it seems like a good time to look forward. Whilst most fans will be focusing on the matches remaining between now and the end of May, Managers and Football boards have to look further ahead. Budgets are being planned, appointments being considered and money, as always , is foremost in the thoughts of Directors and Managers.

Money, if you have it , can solve short term challenges, set in place long term strategy and is a mechanism to energise the fanbase. When you don’t have money, the problems and challenges are of a completely different nature. Celtic have money, a lot of money.

The cash balance on 31 December 2018 was £44m. Of course, some of that money has to be spent on wages and suppliers before the year-end. However, Celtic will also receive stage payments on Dembele sale circa €7m before 30 June (it’s common for large fees to be spread over 2 years), management team contract buyout of £9m, SPFL final distribution for 2018-19 season £2.2m, Valencia gate receipts and Hospitality £2.2m, and close to another £2m in match day ticket sales for the 11 SPFL home games taking place since 1 January.

None of this cash was shown in the Interim accounts. Payments will be received for players sold as well as payments made for players already purchased. The Year End cash balance will be a record high beating last year’s figure of £40m.

Everyone will have an opinion of where and how much we should invest, and that will be the subject of another article nearer the season’s end.

The challenges across the City are of a completely different nature. As always the demands there aren’t supported by financial reality, and having gone all in on Caixinha and Gerrard, a new and more challenging reality is looming.

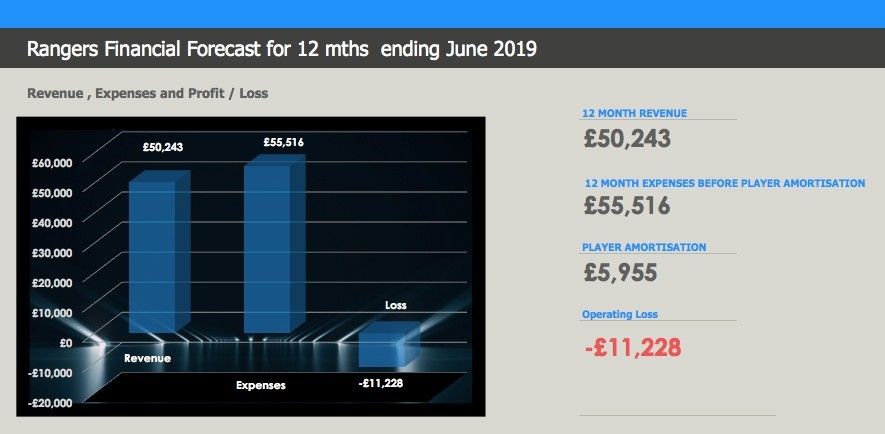

Rangers posted an operating profit of £3.8 Million in the 6 months to 31 December 2018. The Rangers Chairman in his financial review that accompanied the interim accounts stated, “the Club is forecasting to be close to break-even for EBITDA for the year”.

I’m sure that was designed to provide comfort to shareholders and fans alike, however some context is required.

In the full year to 30 June 2018, Rangers produced an EBITDA of a loss of £4.18m. I guess that’s close to break even in some eyes. In the full year to 30 June 2017, Rangers produced an EBITDA loss of £105k. There is no question that is close to break even.

The problem though is that EBITDA (earnings before interest, tax, depreciation and amortisation) is only part of the picture. The more relevant numbers relate to Operating Profit. That and Cash Flow tell a more complete picture on financial health.

From a 2018 EBITDA loss of £4.18 Million, Rangers produced an operating loss of £13.16m and from a virtual break-even 2017 EBITDA, Rangers produced an operating loss of £6.3m. The 2019 Operating result will be another significant loss.

REVENUES

· Rangers had Revenue of £35m in the first half of the current financial year

· Much of that Revenue will not recur in the second half of the year

· There were 7 home games in the Europa League that will have generated close to £9.6m in gate money

· Rangers earned £4.4m in Uefa prize money in the first half , nothing in the second half

· Rangers will play 3 less home SPFL games in the second half resulting in a £3.1m reduction in gate revenue, as season ticket money is allocated to each individual game

· With 10 less home games in the second half , Hospitality and Match day revenues such as parking, catering and programmes, will be down by possibly £3.3 Million

· Other less significant revenues will reduce in line with less games played at home in the second half

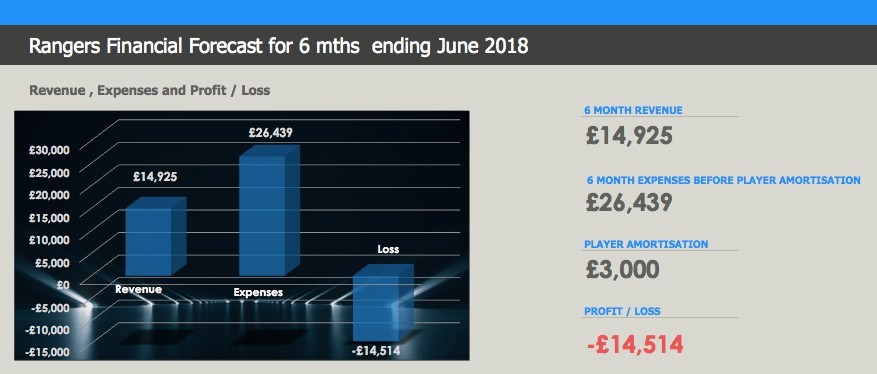

· It’s estimated Rangers will have revenues of close to £14.9m for the second half which is 12% growth on the second half of the financial year to 30 June 2018

EXPENSES

· Rangers won’t have the cost of travel and accommodation for European away games. This should deliver a saving of around £1.5 Million

· There are 10 less home games, which will deliver savings on part time staff, security, Police and utility costs. Should save around £400k

· Pena is now gone. It’s unknown if he was paid off or fired without any contractual settlement. It’s anywhere between a £340k saving or if paid in full (unlikely) an extra expense of £2m. Assumption is he got nothing, so a saving achieved

· Defoe and Davis won’t be cheap, and even Kamara will add a significant amount compared to the first half. Estimate an increase of £1.1m in player wages for these 3 for 6 months

· The first team squad and the management team will have earned bonuses for Europa League Group entry. That won’t recur in the second half . Estimated at £1.5m

· Nothing much happened in terms of players being bought, only Kamara for a small fee. Amortisation charge should be similar to the first half

· All in all, expenses will have reduced by around £2.65m to £26.4m for the second half, making a full year total of £55.5m

The second half of the Year will deliver a large loss of over £14.5m, unless significant player sales are undertaken in June, making an annual operating loss in excess of £11m.

“Be moderate in prosperity, prudent in adversity”, Periander

Nobody could argue against the reality that Rangers have had a mountain of adversity to deal with since 2012. Equally, nobody is ever going to claim they have been prudent. They have borrowed money from the likes of Mike Ashley, raised significant sums in multiple share issues organised by

Charles Green and Dave King, been loaned large interest free sums by shareholders and borrowed at ferocious rates from Close Bros.

What they have never done is provide funding through operational profitability. They are now on their fifth manager since 2012 with none of the major trophies available in Scotland to show for all of the debt and losses incurred. They have only managed to reach one Cup Final in 21 attempts, and even then lost memorably to a Hibernian team inspired by individuals with strong Celtic connections.

The question for Rangers now is what appetite do the shareholders have for risk? There is very little opportunity to grow revenues. Ibrox is full for every game, season books are maxed out. It would take Champions League Group revenue to be a game changer. Celtic are 1/100 to win this year’s SPFL. Rangers are 25/1.

It’s highly unlikely Rangers will even have an opportunity to qualify for the Champions League Group stages before season 2020-21. Even that remains a long shot. In the meantime, the Rangers board have to decide how much appetite they have for risk.

This season is likely, as shown, to deliver an operating loss of £11.2m, which will be reduced by the £2.8m already banked as profit on the sales of Windass and John. Give Gerrard the same budget for 2019-20 and if he delivers the same result, then another £11m operating loss will be the outcome.

Selling Morelos for £20m is the stuff of fantasy . His record pales next to Dembele’s . In fact his record isn’t as good as Leigh Griffiths and we weren’t fending off bids for even 30% of what it’s claimed Morleos will be sold for. Fail to qualify for the Europa League Group Stages and the operating loss will be rocketing towards £22 Million. Who is going to cover that? Will the shareholders continue to fund ever increasing losses for no silverware, or will they prudently use whatever they raise in asset sales to fund some of the losses, and take a long term view by living within their means.. History would suggest they will roll the dice yet again.

As noted earlier, Celtic have very substantial cash reserves. Rangers do not. They effectively have no cash. They exist on Close Bros debt and shareholder loans once the Season Book money runs out, which with the significantly increased budget given to Gerrard, happens earlier than ever and without Europa League Group Revenue, could happen well before the next winter break.

Gerrard improved the European record significantly; he was aided though by as soft a draw in the qualifiers as was possible. There is a strong chance of much better opposition next season.

The Rangers Directors have provided the funds to cover shortfalls up to this point. They are now facing significant challenges. They have seen Gerrard in action for a year. His League and Cup record is no better than Pedro’s. The money from shareholders has all been spent. The Close Bros money will be gone in a few weeks and will then have to be repaid.

Celtic will rebuild in the summer. No guarantees it will be successful, but it will be funded by our own resources and financial reserves. Rangers have no resources of their own and absolutely no financial reserves. At some point those lending money and buying shares will realise this isn’t a calculated risk, it is extreme rashness.

497 Comments- Pages:

- «

- 1

- ...

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

FAVOURITE UNCLE on 25TH MARCH 2019 9:45 AM

If there is story brewing you’ll read about it elsewhere first then JJ will write a blog claiming an exclusive. He is notorious for plagiarism, he must trawl through all the other blogs looking for new content to post. My fav was when a few ppl on twitter started a remour that Grant Russell was leaving STV and would be announced as Sevco new media person. Within a day he had mentioned that he had inside info that GR was taking up a new role at Sevco only for Motherwell to then reveal he was joining them???

new article posted.

New manager will demand funds unless it’s Lenny – so it’s Lenny.